IRS 1099-NEC Form: Reporting Contractors Payout

As we dive into taxation, it's essential to understand the various documentation involved. Among them, IRS tax form 1099-NEC is particularly relevant for many taxpayers. This form is designed for reporting non-employee compensation, hence the abbreviation NEC. Any individual or entity that pays at least $600 to another entity or individual for services, not including material and equipment, throughout the year, is obligated to fill in Form 1099-NEC.

Our Website Advantages

In the intricate road of taxation forms, our website, 1099nec-irsform.com, emerges as an invaluable resource. Our website allows you to analyze instructions with real-world examples, making the completion process less daunting. A user-friendly interface presents IRS Form 1099-NEC for 2023 with instructions for the relevant year. Besides offering a step-by-step guide, the site explains tax-related terms in easy-to-understand ways, enabling users to navigate the complexities of tax filings with increased confidence and understanding. So next time you need to download the 1099-NEC form for free, visit our website for a smoother experience.

Table of Contents

IRS Tax Form 1099-NEC & Businesses That Need It

Businesses that have made payments of $600 or more to a non-employee, such as freelancers or independent contractors, during the tax year are required to file an important document. This document, known as the 1099-NEC IRS Form for 2023, is a crucial part of their tax obligations and helps ensure accurate reporting of payments.

Example of the 1099-NEC Use

Jane Doe, a freelance graphic designer based out of Austin, Texas, is an outstanding example of a professional who strongly connects with the IRS Form 1099-NEC for nonemployee compensation, which is integral to her freelance work. This IRS form that governs nonemployee compensation heavily influences her livelihood and tax obligations, making her the perfect example of its practical application. Jane transitioned from her full-time job to freelance work last year, taking on multiple clients across various sectors. As part of her branding services, she developed websites, designed logos, and provided marketing visual aids, earning over $600 from each client.

Given this work mode, Jane's clients must file the 1099-NEC to the IRS for every instance wherein they've paid her $600 or up within the tax year. For Jane, this means she must maintain meticulous track of her income and expenses, as she will receive 1099-NEC forms from each client who hits that payment threshold. This gives the IRS a detailed overview of Jane's income, ensuring accurate taxation considering her new freelance status.

Features of the 1099-NEC Template

-

![Efficiency Boost]() Efficiency BoostIt provides a simplified method to report non-employee compensation, reducing paperwork and time spent on processing different forms. Unlike the 1099-MISC form used previously, the 1099-NEC is exclusively dedicated to independent contractors, freelancers, and other non-employees.

Efficiency BoostIt provides a simplified method to report non-employee compensation, reducing paperwork and time spent on processing different forms. Unlike the 1099-MISC form used previously, the 1099-NEC is exclusively dedicated to independent contractors, freelancers, and other non-employees. -

![Accuracy Assurance]() Accuracy AssuranceBy using the IRS 1099-NEC printable form, businesses can improve the accuracy of their tax filings. Specificity of the form results in lower chances for errors because it only pertains to non-employee compensation. It helps in filing correct taxable income amounts, ensuring tax compliance.

Accuracy AssuranceBy using the IRS 1099-NEC printable form, businesses can improve the accuracy of their tax filings. Specificity of the form results in lower chances for errors because it only pertains to non-employee compensation. It helps in filing correct taxable income amounts, ensuring tax compliance. -

![Deadlines Distinction]() Deadlines DistinctionThe distinct deadline of January 31st for the 1099-NEC separates it from other reports. This clear demarcation allows businesses to focus, ensuring they complete the necessary financial reporting on time. The early deadline also helps recipients in planning their tax responsibilities.

Deadlines DistinctionThe distinct deadline of January 31st for the 1099-NEC separates it from other reports. This clear demarcation allows businesses to focus, ensuring they complete the necessary financial reporting on time. The early deadline also helps recipients in planning their tax responsibilities.

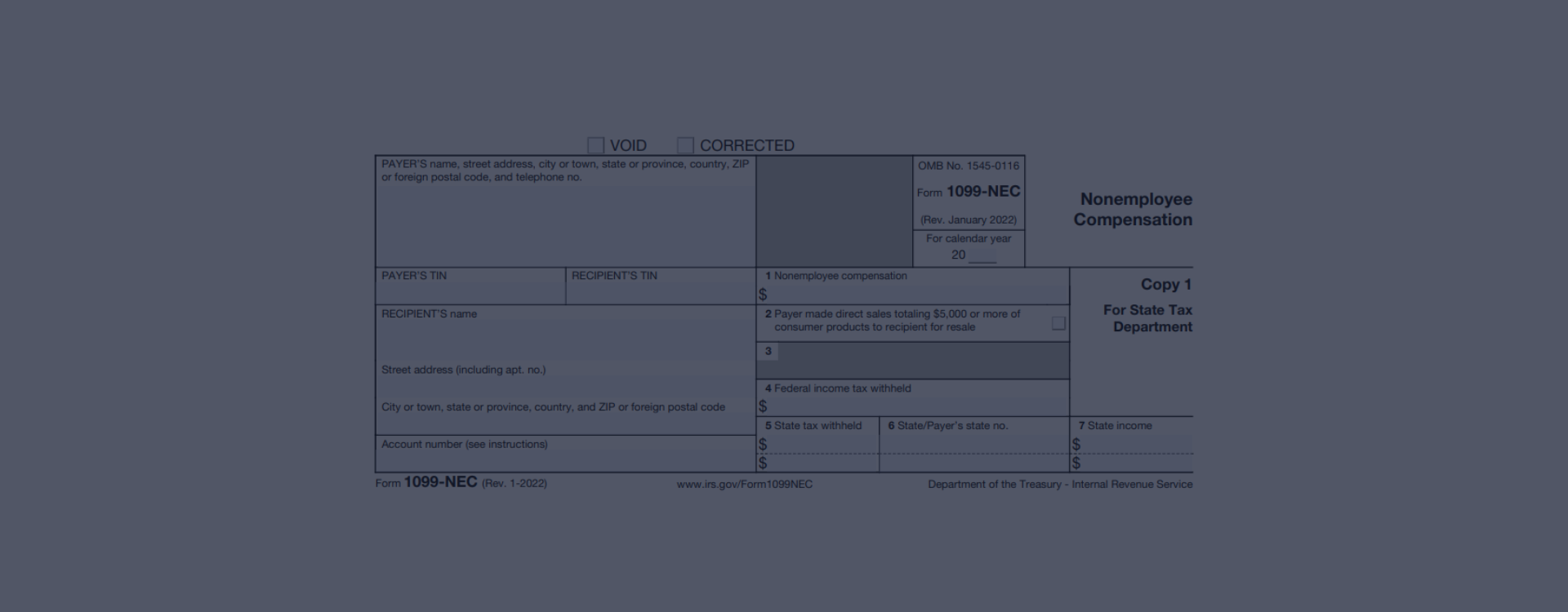

Blank 1099-NEC Form for 2023

Get FormFilling Out the 1099-NEC Form Step by Step

Figuring out your taxes can be tedious, but it is a task that cannot be avoided. A necessary part of the process is filling out forms like the IRS 1099-NEC. Luckily, we have some helpful IRS 1099-NEC form instructions to guide you!

- Step one is finding the form. You can fill out the 1099-NEC online for free by accessing the template from our website. It's easy to find and makes the task more convenient.

- Step two involves understanding what each box in the free 1099-NEC form template signifies. This includes your Identification Number, recipient's details, contact info, and the total amount you paid.

- Now, onto step three. Fill out each box carefully. One of the most common mistakes when filling out forms involves data entry errors. Ensure the information you've entered matches your records.

- Last, in step four, review all your inputs. Recheck everything for accuracy to avoid unnecessary IRS issues.

In short, filling out your 1099-NEC doesn't have to be daunting. By following these tips, you can navigate the process smoothly and accurately.

Form 1099-NEC Due Date

Friendly reminder to all our readers: it's that time of the year to get your financial ducks in a row. The due date to file your 1099-NEC tax form for 2023 is January 31, 2024. Remember, the IRS waits for no one!

Get FormForm 1099-NEC & IRS Penalties

That said, being transparent and honest when dealing with Uncle Sam is crucial. As we've seen in previous years, there are penalties for late filing or for providing incorrect or falsified information on your tax documents. These penalties often increase with the severity of the infraction. Fines can range from a flat $50 to a steep 100% of the total taxes owed, depending on circumstances. So, let's keep it honest and timely, friends - it'll save money and stress.

Common Errors on Printable 1099-NEC Form

- First, individuals often inaccurately fill the "nonemployee compensation" box. This box should include any $600 or more payments during the tax year.

- Second, many need to be more accurate with their workers, leading to incorrect filing of the 1099-NEC instead of a W-2 form. Legally, it's crucial to differentiate between employees and independent contractors correctly.

- Finally, businesses frequently miss the IRS deadline for 1099-NEC filing, which is January 31. Missing the deadline could result in penalties, so be prompt and timely to avoid complications.

Form 1099-NEC for 2023: Frequently Asked Questions

- What is the purpose of the printable IRS Form 1099-NEC?The document serves a crucial purpose in the fiscal landscape. It is typically submitted by a company to report non-employee compensation, such as freelance or contractor income, above $600 during a tax year. This document allows the IRS to track income individuals may have earned outside of traditional employment.

- Where can I find the IRS Form 1099-NEC in PDF?You can find the current 1099-NEC in PDF here on our site. Downloading the form in PDF format allows you to fill it out digitally or print it for manual submission quickly. Always ensure you use the most recent edition to prevent processing delays.

- Can I fill out the IRS Form 1099-NEC online?Absolutely. Our website provides the IRS Form 1099-NEC fillable online. This facility allows you to enter your information directly into the form on our secure site. Once complete, you can print or save the form for your records or submission.

- How can I get a print blank 1099-NEC form?If you'd like a paper copy to fill out by hand or to keep for your records, you can print a blank 1099-NEC form here on our website. Simply download, print, and it's ready to use. It's a tangible way to organize and manage your tax-related information.

- When will the 2023 1099-NEC template be available?Typically, the IRS releases the new 1099-NEC template for the upcoming year in the latter part of the current year. So, you can expect to see the new 1099-NEC sample available on our site around late 2022. Keep checking back for updates to stay ahead of your tax preparation.

More Form 1099-NEC Instructions & Samples

1099-NEC Printable Template When it comes to dealing with non-employee compensation, the blank 1099-NEC form printable is an indispensable tool. These forms are used for reporting payment information to the IRS by businesses. Whether you're an independent contractor or a business owner, it's crucial to understand the layout an...

1099-NEC Printable Template When it comes to dealing with non-employee compensation, the blank 1099-NEC form printable is an indispensable tool. These forms are used for reporting payment information to the IRS by businesses. Whether you're an independent contractor or a business owner, it's crucial to understand the layout an... - 16 November, 2023

- Free Fillable 1099-NEC Form The concept of taxes, filing returns, and form-filling can be daunting, especially for those unfamiliar with the procedure. One such essential document is the 1099-NEC form. Businesses commonly use it to report payments made to non-employee service providers, such as independent contractors. The Int...

- 15 November, 2023

- Free 1099-NEC Template Welcome, dear readers. As tax season approaches, many of you are likely sorting through various forms and requirements. A critical piece of this puzzle for those who have engaged in business or trade payments to non-employees is the 1099-NEC form. Inherent within its simplicity are the complexities...

- 14 November, 2023

Please Note

This website (1099nec-irsform.com) is an independent platform dedicated to providing information and resources specifically about the 1099-NEC tax form, and it is not associated with the official creators, developers, or representatives of the form or its related services.